Helsinki, January 5, 2015

Russia grants 150 billion roubles from its National Wealth Fund to gas company Novatek’s Yamal LNG project.

Among his last government decisions in 2014, Prime Minister Dmitry Medvedev approved Novatek’s application for state support to Yamal LNG developments. They were allocated 150 billion roubles (€ 2.1 billion) from the National Wealth Fund to the project.

The support will enable Novatek to continue its development of the Yamal LNG, a grand energy and infrastructure project on Russia’s Arctic Yamal Peninsula. Once on full awing, the Yamal LNG plant will have the capacity to produce around 16.5 million tons of LNG per year, all go it extracted at the nearby South Tambley field. The project also includes the development of the Sabetta port, a major infrastructure hub on eastern shore of the peninsula.

The 150 billion roubles are to be invested in the construction of LNG plant, as well as auxiliary production, processing and unloading facilities.

The Russian government has from before invested heavily in Yamal project. More than 47 billion roubles has been invested in the Sabetta port and auxiliary infrastructure.

The Sabetta harbor will be able to handle more than 30 million tons of goods per year and should operate all-year-round, despite the highly complex ice conditions of the Ob Bay.

There are other companies applying for state support as well. One of them is Rosneft. The bids for state support emerged as companies face major hardship following western sanctions and limited possibilities to get foreign credits.

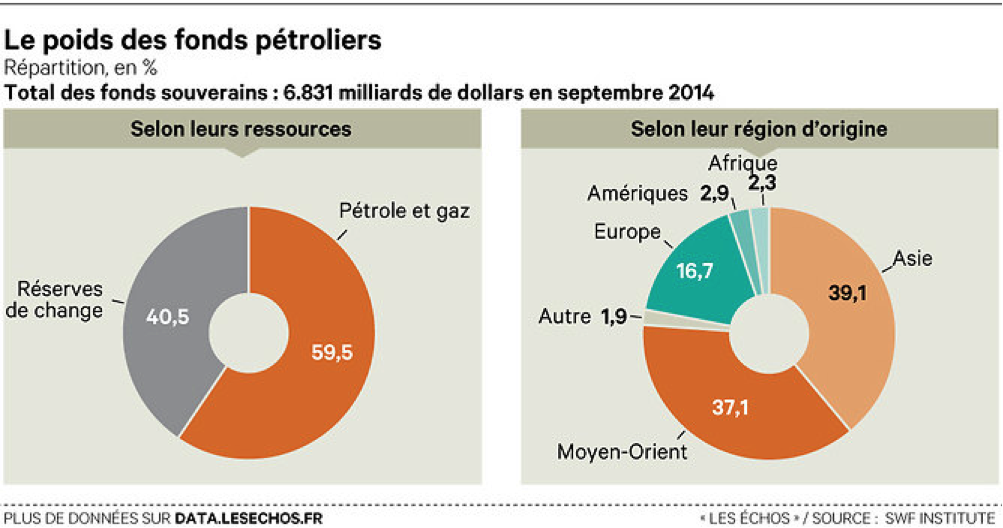

The National Wealth Fund is one of the two state investment funds, both of them established in 2008. The National Welfare Fund was initially given $87.97 billion. The fund is controlled by the Minitry of finance and one of its main responsibilities is to support the Russian pension system.

Novatek is the Russia’s biggest independent gas producer, partly controlled by structures associated with businessmen Gennady Timchenko and Leonid Mikhelson, two businessmen with good relations with Kremlin.

NOVATEK started in August 1994, when AOOT FIK Novafininvest was established (the name was changed to OAO NOVATEK later). The new Company focused on oil and gas assets development from the very beginning.Novatek acquired the exploration and production licenses in the YNAO (East-Tarkosalinskoye, Khancheyskoye and Yurkharovskoye fields) and made significant investments in the fields development and surface facilities construction. The trial operation of the East-Tarkosalinskoye oil field commenced in 1996 and commercial production of natural gas started in 1998. Gas marketing development commenced in 2002 with first natural gas sales to end-customers.

The company completed the consolidation of NOVATEK’s main assets in 2004 and disposed the non-core businesses – in 2005 in order to focus on its core assets.

The Purosky Condensate Processing Plant was commissioned the same year becoming the most important element of the vertically integrated production chain of the Company and the Company’s IPO was conducted on the London stock exchange and Russia’s MICEX stock exchange.

With over 25 bcm production per annum NOVATEK was the largest independent producer in Russia as earlier as 2005 and retained its market position afterwards. The Company’s production volumes and asset portfolio grew rapidly in the subsequent years. NOVATEK acquired stakes in SeverEnergia, Nortgas and Yamal LNG, as well as new licenses including prospective areas in the Gydan Peninsula and the Gulf of Ob.NOVATEK launched a large-scale project on LNG plant construction (Yamal LNG) which will enable the Company to enter the international gas market.

Source:

http://government.ru/dep_news/16397/

http://www.novatek.ru/en/

Our activity produced in 2014 a good operating performance in all its strategic pillars. Resources & Roots is radically developing its relationship model in Switzerland, Finland and Canada and extending its offer to a large number of international partners. Our model, which combines the expertise of investor relationship, financial consulting and business ethics by the proximity of a proactive networking, is insuring a personalised service and an offer which is perfectly tailored to the need and expectations of clients in a complex economic environment.

Our activity produced in 2014 a good operating performance in all its strategic pillars. Resources & Roots is radically developing its relationship model in Switzerland, Finland and Canada and extending its offer to a large number of international partners. Our model, which combines the expertise of investor relationship, financial consulting and business ethics by the proximity of a proactive networking, is insuring a personalised service and an offer which is perfectly tailored to the need and expectations of clients in a complex economic environment. TORONTO, 5 December 2014

TORONTO, 5 December 2014