Toronto, March 2, 2014

The PDAC’s CSR Event Series aims to facilitate multi-stakeholder dialogue and peer learning on key issues related to CSR in the mineral industry. Sessions are free to attend and open to all registered convention delegates.

The PDAC’s CSR Event Series aims to facilitate multi-stakeholder dialogue and peer learning on key issues related to CSR in the mineral industry. Sessions are free to attend and open to all registered convention delegates.

Sunday, March 2

8:30 to 10:00am

The Beyond Zero Harm Framework Organizers: IAMGOLD

How can the mining industry measure and demonstrate changes in well-being of mining-impacted communities? The Beyond Zero Harm Framework provides a comprehensive roadmap to tackling this fundamental question. Developed by a multi-stakeholder working group of companies, NGOs and academics, the tool establishes a participatory framework for measuring and demonstrating these changes. The session will be the first public introduction of the framework.

10:30am to 12:00pm

Getting It Right: Community engagement for junior companies Organizer: Triple R Alliance and PDAC

Community engagement is frequently misunderstood and seen as difficult, costly, and not connected to a company’s bottom line. In reality, engagement can be the most cost-effective approach to mitigating social risks. This session will provide a step-by-step approach to community engagement designed for smaller teams. Practical tools will be provided that companies can apply to projects of any size, at any stage, and in any context.

1:00 to 2:30pm

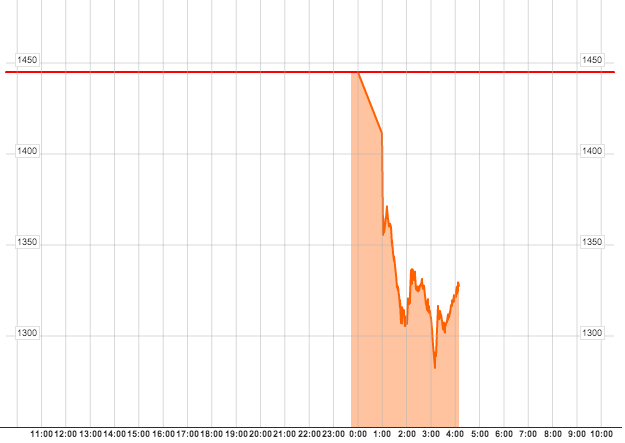

Balancing Performance in Uncertain Times: The relationship between capital markets and environmental and social risks Organizer: Environmental Resources Management (ERM)

This session will examine how effective environmental and social management translates into key finance decisions, whether the capital comes from bank loans, equity markets or cash from existing operations. This panel of top industry executives and financiers will introduce factors currently affecting the capital market climate, and discuss practical ways juniors and majors alike can make a water-tight case for additional funds if they wish to acquire, expand and/or optimize new or current assets.

3:00 to 4:30pm

What You Need to Know and Do: Lessons learned from Mesoamerica Organizer: On Common Ground

Mesoamerica (southern Mexico to Costa Rica) has a current reputation for complex social conflicts. Speakers selected for their willingness to talk candidly about the challenges and opportunities of working with communities in Mesoamerica will provide context for the realities facing explorers on the ground and describe proven tools to address this reality. Facilitated discussion with participants will allow further examination of how to avoid the greatest risks, apply the tools and gain a social license.

Monday, March 3

10:30 to 12:00pm

Local Procurement: Strategies, tools and the benefits for companies and communities Organizer: Engineers Without Borders Canada

Through increasing local procurement of goods and services, companies have an effective method of maximizing the benefits of their investment for host communities and countries, while contributing to their social license to operate. Local procurement leads to more local jobs and income, transfers skills and technology, and helps to create vital domestic business networks. This session will showcase different field-tested approaches stakeholders are taking to increase local procurement.

1:30 to 3:00pm

Water, Mining and Stakeholders: Communicating with communities, government and investors Organizer: International Finance Corporation (IFC)

The economic, environmental, social and cultural values of water are one of the most challenging aspects of a mining project to measure and communicate with diverse stakeholder groups. IFC will bring together technical experts on mine development, communications, community engagement, grievance mechanisms and finance to discuss examples of how companies can avoid conflict, engage in effective dialogue, and earn a social license to operate around water.

3:30 to 5:00pm

The Role of Government in Company-Community Relationships: Lessons from Peru Organizer: Peruvian-Canadian Chamber of Commerce

In order to solve the conflicts between companies and communities, the Government of Peru is actively working to change the dynamic between exploration and mining companies and local community stakeholders. With a panel of company, government, and civil society representatives from Peru, this session will examine relationship management at all stages of the mining lifecycle with a focus on the Government of Peru’s role in moving from dialogue tables to development tables.

Tuesday, March 4

4:00 – 5:30pm

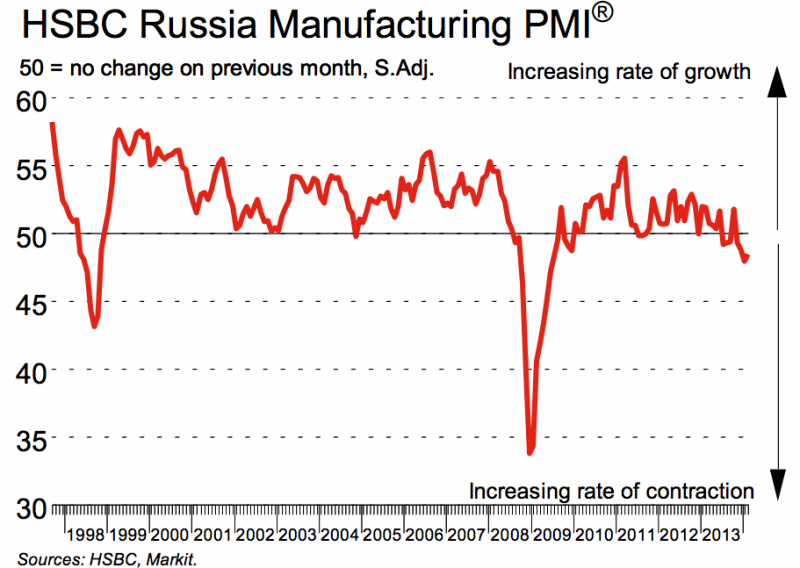

Resource nationalism is commonly cited as the key risk for exploration Resource Nationalism: Moving beyond a narrative of threat Organizer: International Council on Mining and Metals (ICMM) and PDAC and mining companies. Now used as a general label for a series of policy changes, resource nationalism presents significant challenges and opportunities for companies and host governments alike. Through discussion with a panel of leaders from industry, government, and international civil society, this session will address the issues surrounding resource nationalism and start moving the conversation towards a constructive dialogue.

5:30 to 6:30pm

CSR Event Series Closing Reception

A networking reception for CSR practitioners.

More information contact: Emily Nunn – Manager, CSR at enunn@pdac.ca

http://www.pdac.ca